Since I have spent my entire adult life in the financial planning industry, I often forget that many people do not have a clear picture of what financial planning truly is. Why? Because the definition of true “financial planning” is easy to muddle and water down. Many advisors advertise themselves as financial planners and claim to do the same things that I do, but when you look at what they deliver, it’s only a fraction of what they promise. Unfortunately it can be hard to tell what kind of service you will get without taking a chance, but you can improve your chances if you know what to expect in the first place.

What Financial Planning is NOT

Only Insurance: Everyone needs to make enough money to get by, but financial planning is NOT selling one type of product. If the only tool that I have to help with your financial situation is insurance, then I will find a way to sell the idea that the solution to any of your problems is insurance. Just had a baby? Insurance! Bought your first home? Insurance! Trying to pay off your student loans? Insurance? To be clear, there are insurance agents who will look at your entire financial picture, and may actually refrain from selling insurance when it isn’t the right fit. But they are paid to sell insurance, and so there’s an incentive to sell insurance, whenever they are able to.

Only Investment Management: On the other end of the spectrum, just because someone says they are a financial planner, does not mean that they are a financial planner. Now financial planners often specialize so that their business can be more streamlined, which makes sense. But if you only ever talk to your financial planner about your investments, they are an investment manager, not a financial planner. Your investments can certainly be a large part of your financial life, and it is an area that most consumers are less comfortable with, so it can be an easy sell: “Don’t worry about investing. I know how to do that and I’ll just take care of it for you.”

So what’s wrong with someone claiming to be a financial planner, but only providing investment advice? Pricing and advertising. Financial planners charge an average of 1% for assets under management, while you can get the same investment management only approach from Betterment or Wealthfront for 0.25%, or Vanguard Personal Advisor Services for 0.30%. To be fair to these companies, they focus on investments, but are also starting to offer a little more, like a retirement plan, but the focus is on investments, but for much cheaper than a “financial planner” who only manages investments.

Only Anything: Be wary of ANYONE who is only giving advice in one area of your finances and is calling themselves a financial planner. Financial planning is an extremely broad field of study, and while everyone needs to specialize and focus on a few areas, financial planning is all about the interaction of these different areas and getting them to work together.

What Financial Planning IS

Let’s start with a technical definition. Financial planning is a process by which you discover your values, achievements, aspirations, opportunities, and potential threats. You then establish goals based on your values, taking advantage of your opportunities while mitigating your threats. Financial planning does all of this by combining counseling with mathematics, accounting, and the study of law.

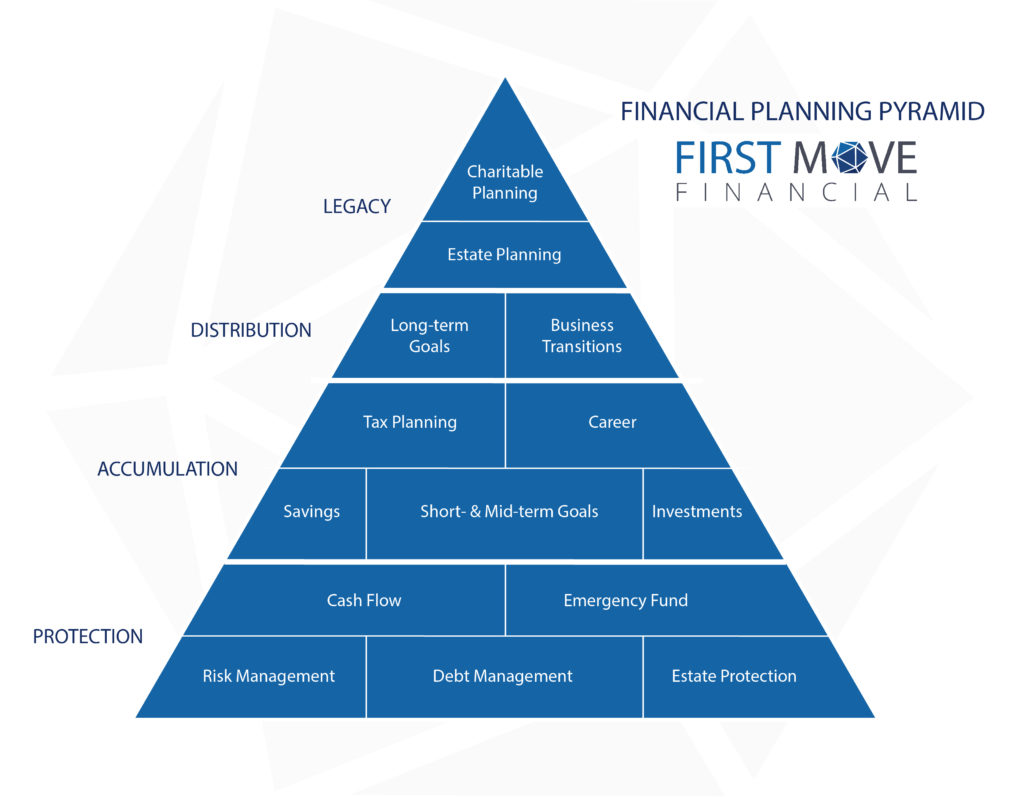

That was a bit broad, wasn’t it? To be more specific, I’ve laid out 12 areas that financial planning can and should cover. While an individual financial planner may focus on one of these areas, they all interact with each other and a competent financial planner will be able to help with all of these areas.

Risk Management - Insurance is not evil, nor are those who sell it, but it simply isn’t the answer to everything. We live with all kinds of risk, some we knowingly accept, some we don’t realize until it is too late. Your financial advisor should be helping you acknowledge which risks you have, and then talk about if you want to self-insure, avoid, mitigate, or insure against the risk.

Retirement - Okay this is an obvious one, but most people only retire once, and knowing how to live the rest of your life without a paycheck is not the easiest thing to do, let alone to plan for when you don’t have experience with retirement. So working with someone who has helped people retire and helped people in retirement can be very valuable. Preparing for retirement takes an understanding of investments, tax laws, employee benefits, and personal behaviors.

Debt Management - One of my qualms with many financial advisors is the way they prefer investing over paying off debt. For example, if you ask if you should pay off your debt or invest for retirement, many will answer that you should invest without analyzing your situation. Investments are scarier to those who don’t understand them, and it’s an easy thing to sell your expertise in. Coming up with a debt management strategy is not something most people think of hiring a professional to help with. For my family, we feel a lot of undo stress when we have debt, so we have always paid off our debts as quickly as we can. That’s not the case for everyone, but an advisor would be doing me a disservice if they did not understand the stress that debt adds to my life.

Planning for College - College costs are out of control, and while the increase has slowed, it still outpaces inflation in the rest of our lives. How do we pay for our kids to go to college? Should we pay for our kids to go to college? Will it help our children become responsible adults to pay part of their own way? 529, Coverdell, Roth, UTMA, brokerage account? Your financial advisor should help you work through these questions and more about college planning.

Taxes - Not many financial advisors can prepare your taxes for you, but every single one of them should be able to give you a very good estimate of what you will pay. More than that, they should proactively work with you to manage your tax liability. Did you know that your taxes go down when you retire and aren’t earning an income? Did you know that they go back up when you start to collect Social Security and take your Required Minimum Distributions from your 401(k)? Did you know you can reduce your overall tax hit by using that window of time when your taxes are lower? Did you know that there are MANY other periods of your life where you can take steps that will save you a lot of money you’d otherwise pay in taxes?

Budgeting - Quick! Without looking, what is your annual overall spending? This is an area that many people need at least some help with, but never realized financial planners can provide that help. Now, I’m not you, and I cannot/should not judge what you spend your money on. That’s for your family to decide. However, I can help guide those conversations and help your family establish an intentional budget that is in line with your values and works toward your goals. Then I can help you find tools that help you keep to your budget by providing accountability and transparency.

Goal Planning - What is your next major goal? Most of us have to pause for a moment and think about it. That word “next” makes it even more tricky. Almost every financial advisor out there will help you work toward your retirement goal, but do you have other goals that require your time or money? Did you know that financial advisors can help with those as well? If you aren’t regularly being asked about your next goals, and what progress you’re making toward them, you may need a new financial advisor.

Savings - Going hand in hand with goals is your savings. How much should you save? Where? Do you just save everything in one big pot, and pay for all of your goals from there? This is part of budgeting, part of goal planning, part of debt management, part of investing, and should be part of the conversation.

Career Planning - Now most financial advisors will not be skilled enough to be a career counselor for you. However, the largest asset we all have when we’re young is our Human Capital. Even if your advisor isn’t able to help advance your career, they should be helping you examine job offers, and take your career into consideration when building your investment portfolio.

Business Transitions - For any small business owner out there, transitioning your business to someone else is likely going to be harder for you than starting the business was. I’m in the middle of starting my business and I know how hard that is, but I’ve also been a part of multiple transition plans that fell apart because the owner just wasn’t ready. Not all financial advisors will be able to help with preparing you to let go of your business, but they should be talking to you about how difficult it is, what you’ll do with your time, and what you expect from the new owners, not just what you’ll do with the cash you get from the sale.

Estate Planning - We spend our lives accumulating stuff. Some of it we want, some we need, and some has a special meaning to us. Your financial advisor should know what your plans are for all of your stuff when you pass, not just your accounts. Too many families fight over the stuff in the estate, so including a professional in planning for the distribution of that stuff can help when the time comes. It’s worse when there are minor children and no guardian has been named. This is not a pleasant conversation, but your advisor should be forcing you to think about these things until you have a plan in place.

Charitable Planning - Many people have a cause they care about and want to support. A financial planner can help you structure your giving so you also reduce your taxes, or so you’re able to give a larger amount. This should be included in your talks about taxes, estate, and budgeting.

These are just 12 of the major areas that financial planners can cover with their clients. So when you are interviewing potential financial planners, think about which areas you would like help in, and make sure the advisor you hire has the expertise to help in your situation. Then you will have found an advisor who can help you plan your financial future, not simply sell you investments and insurance.